Is Nipah Virus Covered by your Insurance?

The short answer is yes. In most standard medical insurance policies, hospitalisation due to viral infections, including rare ones like Nipah is covered under "Inpatient Treatment" or "Hospitalisation and Surgical" benefits.

The recent reports of a Nipah virus outbreak in West Bengal have brought back a lot of uneasy memories for those of us in Southeast Asia. While the news can feel like a heavy callback to the early 2000s, understanding what we are dealing with helps take the edge off the fear.

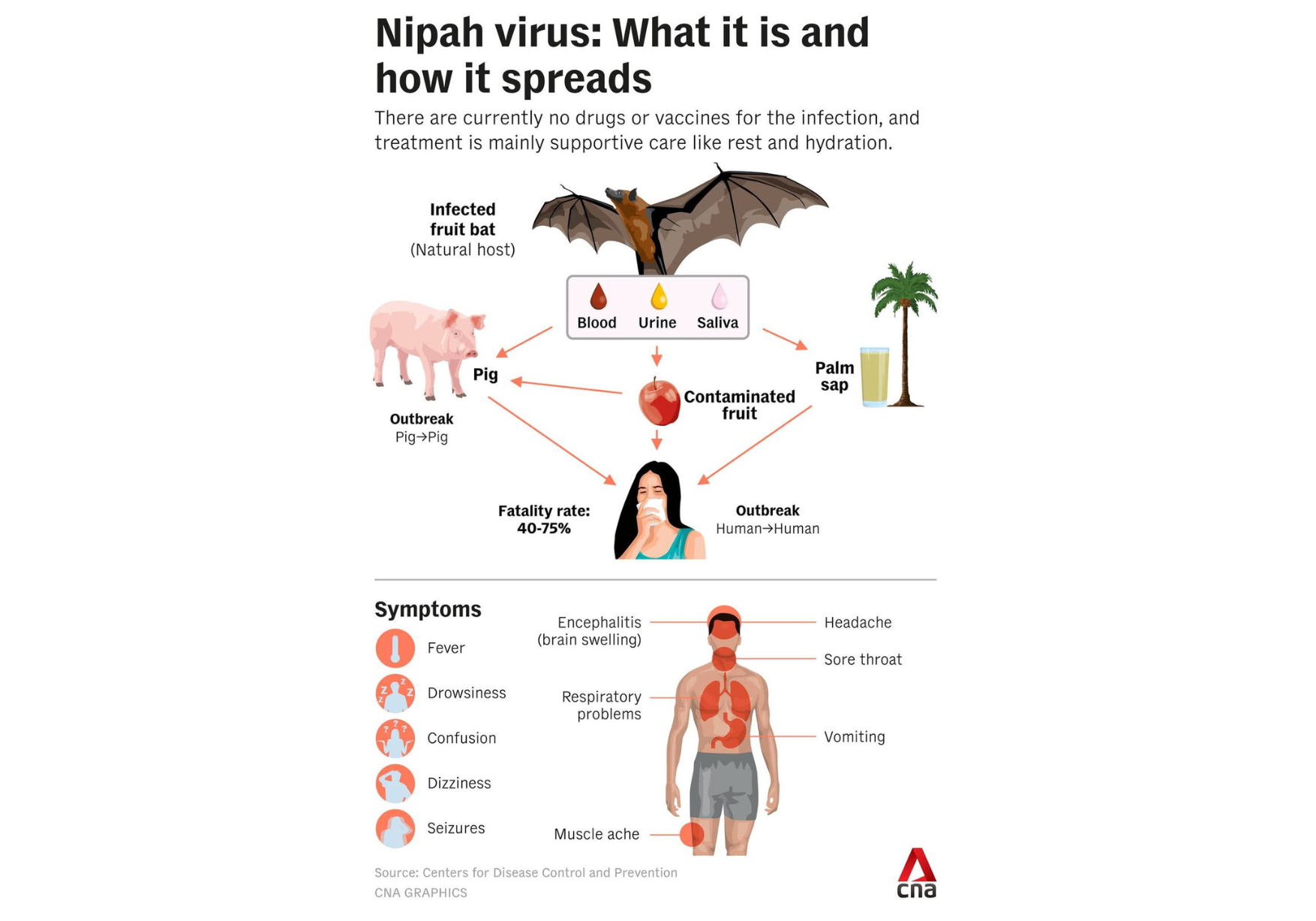

Nipah is a zoonotic virus, which is just a technical way of saying it jumps from animals to humans. In most cases, fruit bats are the original source. People usually get sick if they come into contact with the bodily fluids of an infected animal or eat food that bats have nibbled on. It can also spread between people through very close contact.

When someone catches the virus, it usually starts out looking like a bad case of the flu. You might see a high fever, headaches, and a nasty cough. The dangerous part is that it can quickly escalate to inflammation of the brain, which leads to confusion or even a coma. Because there is no specific vaccine yet, doctors focus on keeping the patient stable and managing the symptoms as best they can.

What is covered by your Insurance?

1. Hospitalisation & Medical Bills

As long as the hospitalisation is deemed medically necessary, standard health insurance typically covers:

- ICU and room charges.

- Doctor’s consultation fees.

- Diagnostic tests and supportive treatments.

2. Critical Illness (CI) Payouts

Nipah virus is rarely listed by name in Critical Illness policies. However, it often qualifies for a lump-sum payout under related conditions:

- Encephalitis: If the virus leads to severe brain inflammation with permanent neurological deficit, it is often a covered "Critical Illness."

- Major Organ Failure: If the infection causes complications like end-stage lung disease or kidney failure.

When is Nipah Excluded?

1. The "Pandemic/Epidemic" Exclusion

Some older or specific travel insurance policies contain a General Exclusion for Pandemics or Epidemics declared by the World Health Organization (WHO). If the WHO officially declares Nipah a pandemic (which it currently is not), these specific policies might cease to cover new claims related to it.

Note: Most modern Malaysian medical cards have removed this exclusion for hospitalisation, but it remains common in Travel Insurance.

2. Waiting Periods

If you just purchased a new policy, there is usually a 30-day waiting period for illnesses. If an outbreak occurs and you fall ill within those first 30 days, the claim will likely be excluded.

3. Government-Mandated Quarantine

If the government requires you to stay in a designated quarantine center (rather than a private hospital) where the government bears the cost, your private insurer will generally not pay out, as there is no "loss" or bill incurred by you. However, some policies offer a "Hospital Income" benefit that pays a daily cash amount regardless of who pays the bill.

While the risk of a local outbreak remains low, staying informed and maintaining hygiene, like washing fruits and avoiding raw date palm sap, remains your best defense.